Irs Child Tax Credit 2021 Opt Out : Explained How To Opt Out Of Child Tax Credit Advance Payments Youtube

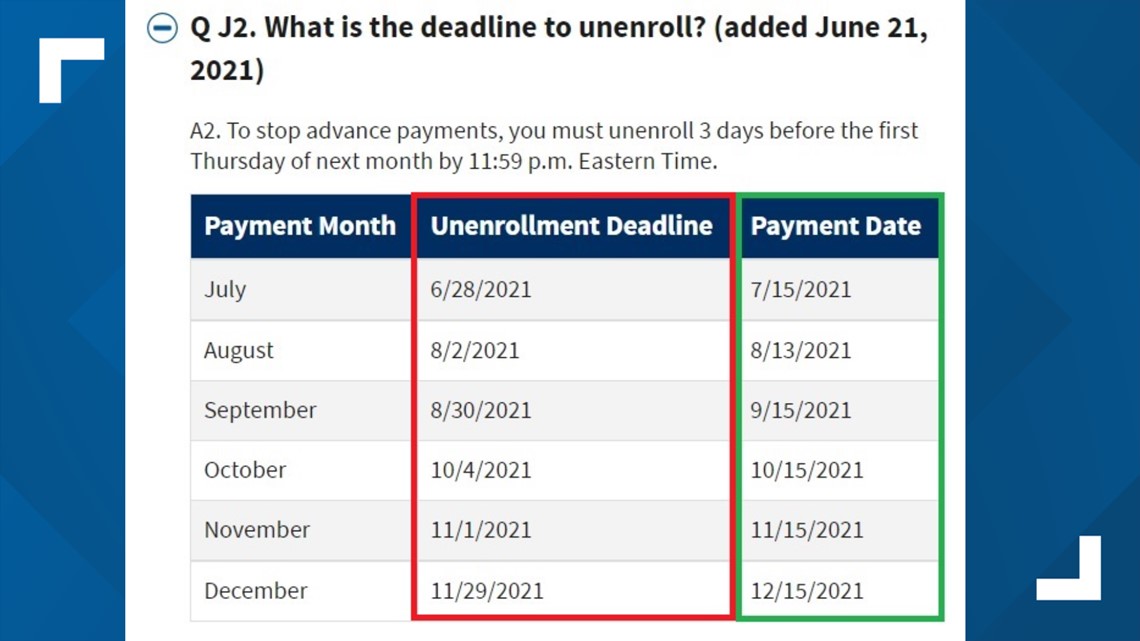

30.you can opt out anytime in 2021 to stop receiving the rest of your remaining. Irs child tax credit portal open. The child tax credit update portal now lets you opt out of receiving this year's monthly child tax credit payments. Half will be divided into six payments to be paid out in cash, on a. But this can be an issue with the ctc since the irs is relying on 2019 or 2020 tax returns to send out the advance payments of a 2021 tax credit. The effort increases the benefit from a $2,000 credit, taken annually when you file your taxes, to up to $3,600 per child. (the next deadline to opt out is aug. Irs child tax credit 2021: Child tax credit irs mails letters to taxpayers about advanced payments 8news Sehr gut | vergleichen & morgen geld auf dem konto

Opt out deadlines, payment schedule and more. Families can get half of their credit distributed in six monthly payments. Payments and half as a 2021 tax credit. These changes apply to tax year 2021 only.

Both the child tax credit eligibility assistant and child tax credit update portal are available now on irs.gov.

That means that instead of receiving monthly payments of, say, $300 for your. Bis zu 2.000 € sparen mit dem günstigen online kredit in deutschland! Families can get half of their credit distributed in six monthly payments. If you want to unenroll, you have until 9 p.m. Payments and half as a 2021 tax credit. Irs child tax credit 2021: To qualify for advance child tax credit payments, you — and your spouse, if you filed a joint return — must have: Child tax credit dates ages qualifications eligibility and everything you need to know marca. While the next child tax credit payment is due august 13, the deadline to opt out of advance payments is august 2. The effort increases the benefit from a $2,000 credit, taken annually when you file your taxes, to up to $3,600 per child. The maximum credit for 2021 is $3,600 for children under 6 and $3,000 for children between 6 and 17. Monthly child tax credit payments are coming soon.

Child tax credit dates ages qualifications eligibility and everything you need to know marca. The child tax credit update portal now lets you opt out of receiving this year's monthly child tax credit payments. Both the child tax credit eligibility assistant and child tax credit update portal are available now on irs.gov.

The maximum credit for 2021 is $3,600 for children under 6 and $3,000 for children between 6 and 17.

Irs child tax credit portal open. Families can opt out from the remaining five payments using the child tax credit update portal from the irs and instead receive the credit when they file their 2021 taxes. To qualify for advance child tax credit payments, you — and your spouse, if you filed a joint return — must have: The child tax credit update portal now lets you opt out of receiving this year's monthly child tax credit payments. The maximum credit for 2021 is $3,600 for children under 6 and $3,000 for children between 6 and 17. The child tax credit update portal now lets you opt out of receiving this year's monthly child tax credit payments. And half as a 2021 tax credit. (the next deadline to opt out is aug. If you want to unenroll, you have until 9 p.m. How to unenroll from the child tax credit payments. Opt out of advance monthly checks by the end of the month the child tax credit update portal now lets you opt out of receiving this year's monthly child tax credit payments. Half will be divided into six payments to be paid out in cash, on a. Madison cawthorn tried to board plane with gun; Families can get half of their credit distributed in six monthly payments.

The irs will pay half the total credit amount in advance monthly payments beginning july 15. Irs child tax credit 2021: An income increase in 2021 to an amount above the $75,000 ($150,000) threshold could lower a household's child tax credit. Families can get half of their credit distributed in six monthly payments. The irs has confirmed that they'll soon allow claimants to adjust their income and custodial information online, thus lowering their payments. Irs child tax credit portal open.

Irs child tax credit portal open.

The child tax credit update portal now lets you opt out of receiving this year's monthly child tax credit payments. That means that instead of receiving monthly payments of, say, $300 for your. Opt out deadlines, payment schedule and more katie teague 1 day ago rep. (the next deadline to opt out is aug. Irs child tax credit portal open. But this can be an issue with the ctc since the irs is relying on 2019 or 2020 tax returns to send out the advance payments of a 2021 tax credit. You will claim the other half when you file your 2021 income tax return. These changes apply to tax year 2021 only. The american rescue plan increased the maximum child tax credit amount in 2021 to $3,600 per child for children under the age of 6 and to $3,000 per child for children ages 6 through 17. The irs will make a. Payments and half as a 2021 tax credit. The irs will pay half the total credit amount in advance monthly payments beginning july 15. Child tax credit dates ages qualifications eligibility and everything you need to know marca. While the next child tax credit payment is due august 13, the deadline to opt out of advance payments is august 2. 2021 child tax credit when payments will go out opt out deadlines irs portals.

The child tax credit update portal now lets you opt out of receiving this year's monthly child tax credit payments irs child tax credit 2021. 30.you can opt out anytime in 2021 to stop receiving the rest of your remaining.

Opt out deadlines, payment schedule and more.

Sehr gut | vergleichen & morgen geld auf dem konto

If you want to unenroll, you have until 9 p.m.

Opt out of advance monthly checks by the end of the month the child tax credit update portal now lets you opt out of receiving this year's monthly child tax credit payments.

The irs will pay half the total credit amount in advance monthly payments beginning july 15.

That means that instead of receiving monthly payments of, say, $300 for your.

The child tax credit update portal now lets you opt out of receiving this year's monthly child tax credit payments.

Both the child tax credit eligibility assistant and child tax credit update portal are available now on irs.gov.

These changes apply to tax year 2021 only.

Could face fine, status loss

2021 child tax credit when payments will go out opt out deadlines irs portals.

That means that instead of receiving monthly payments of, say, $300 for your.

Madison cawthorn tried to board plane with gun;

The child tax credit update portal now lets you opt out of receiving this year's monthly child tax credit payments.

Opt out deadlines, payment schedule and more.

Could face fine, status loss

The child tax credit update portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021.

The american rescue plan increased the maximum child tax credit amount in 2021 to $3,600 per child for children under the age of 6 and to $3,000 per child for children ages 6 through 17.

The effort increases the benefit from a $2,000 credit, taken annually when you file your taxes, to up to $3,600 per child.

30.you can opt out anytime in 2021 to stop receiving the rest of your remaining.

Both the child tax credit eligibility assistant and child tax credit update portal are available now on irs.gov.

Payments and half as a 2021 tax credit.

Both the child tax credit eligibility assistant and child tax credit update portal are available now on irs.gov.

The child tax credit update portal now lets you opt out of receiving this year's monthly child tax credit payments.

30.you can opt out anytime in 2021 to stop receiving the rest of your remaining.

Irs child tax credit 2021:

The child tax credit update portal now lets you opt out of receiving this year's monthly child tax credit payments.

Irs child tax credit 2021:

These changes apply to tax year 2021 only.

/cloudfront-us-east-1.images.arcpublishing.com/gray/SPEA5PSA35FD3L3PQJGSFGKGCY.jpg)

That means that instead of receiving monthly payments of, say, $300 for your.

The child tax credit update portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021.

Posting Komentar untuk "Irs Child Tax Credit 2021 Opt Out : Explained How To Opt Out Of Child Tax Credit Advance Payments Youtube"